Tuesday, June 29, 2010

Krugman: A Coming Depression????

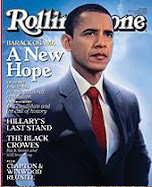

Paul Krugman has been almost a lone voice on the need, in this economic downturn, to urge the need for more spending not less. Krugman's logic seems sound but the last remnants of the Reagan Revolution struggle to stay their demise. Apart from the economics, and with the election of America's first African American President, the white nationalism that is at the core of Reaganism has turned the Republicans into the "Party of No." As the intellectual leader of the Republican party has said: "I want this President to fail." In this context of Republican obstructionism, getting meaningful legislation passed requires compromises that make most of the historic policies more symbolic than substantial in the change they represent. This is the context that the President faces as he attempts to implement policies that help the American people, including people who have been harmed by the economic downturn.

Having said that, it is this dying "Reaganism" that stands in the way of policies that would most turn around this economy. With the gusher in the Gulf of Mexico, the need for a dramatic and dynamic shift to renewable energy would seem to be opportune. There is a need for bold moves FDR moves to get out of this economic slump that could become, as warned by Krugman, a full fledged depression. Unfortunately, this stalemate could stand in the way of a full economic recovery on the President's watch. RGN

June 27, 2010

The Third Depression

By PAUL KRUGMAN

Recessions are common; depressions are rare. As far as I can tell, there were only two eras in economic history that were widely described as “depressions” at the time: the years of deflation and instability that followed the Panic of 1873 and the years of mass unemployment that followed the financial crisis of 1929-31.

Neither the Long Depression of the 19th century nor the Great Depression of the 20th was an era of nonstop decline — on the contrary, both included periods when the economy grew. But these episodes of improvement were never enough to undo the damage from the initial slump, and were followed by relapses.

We are now, I fear, in the early stages of a third depression. It will probably look more like the Long Depression than the much more severe Great Depression. But the cost — to the world economy and, above all, to the millions of lives blighted by the absence of jobs — will nonetheless be immense.

And this third depression will be primarily a failure of policy. Around the world — most recently at last weekend’s deeply discouraging G-20 meeting — governments are obsessing about inflation when the real threat is deflation, preaching the need for belt-tightening when the real problem is inadequate spending.

In 2008 and 2009, it seemed as if we might have learned from history. Unlike their predecessors, who raised interest rates in the face of financial crisis, the current leaders of the Federal Reserve and the European Central Bank slashed rates and moved to support credit markets.

Unlike governments of the past, which tried to balance budgets in the face of a plunging economy, today’s governments allowed deficits to rise. And better policies helped the world avoid complete collapse: the recession brought on by the financial crisis arguably ended last summer.

But future historians will tell us that this wasn’t the end of the third depression, just as the business upturn that began in 1933 wasn’t the end of the Great Depression. After all, unemployment — especially long-term unemployment — remains at levels that would have been considered catastrophic not long ago, and shows no sign of coming down rapidly. And both the United States and Europe are well on their way toward Japan-style deflationary traps.

In the face of this grim picture, you might have expected policy makers to realize that they haven’t yet done enough to promote recovery. But no: over the last few months there has been a stunning resurgence of hard-money and balanced-budget orthodoxy.

As far as rhetoric is concerned, the revival of the old-time religion is most evident in Europe, where officials seem to be getting their talking points from the collected speeches of Herbert Hoover, up to and including the claim that raising taxes and cutting spending will actually expand the economy, by improving business confidence. As a practical matter, however, America isn’t doing much better. The Fed seems aware of the deflationary risks — but what it proposes to do about these risks is, well, nothing. The Obama administration understands the dangers of premature fiscal austerity — but because Republicans and conservative Democrats in Congress won’t authorize additional aid to state governments, that austerity is coming anyway, in the form of budget cuts at the state and local levels.

Why the wrong turn in policy? The hard-liners often invoke the troubles facing Greece and other nations around the edges of Europe to justify their actions. And it’s true that bond investors have turned on governments with intractable deficits. But there is no evidence that short-run fiscal austerity in the face of a depressed economy reassures investors. On the contrary: Greece has agreed to harsh austerity, only to find its risk spreads growing ever wider; Ireland has imposed savage cuts in public spending, only to be treated by the markets as a worse risk than Spain, which has been far more reluctant to take the hard-liners’ medicine.

It’s almost as if the financial markets understand what policy makers seemingly don’t: that while long-term fiscal responsibility is important, slashing spending in the midst of a depression, which deepens that depression and paves the way for deflation, is actually self-defeating.

So I don’t think this is really about Greece, or indeed about any realistic appreciation of the tradeoffs between deficits and jobs. It is, instead, the victory of an orthodoxy that has little to do with rational analysis, whose main tenet is that imposing suffering on other people is how you show leadership in tough times.

And who will pay the price for this triumph of orthodoxy? The answer is, tens of millions of unemployed workers, many of whom will go jobless for years, and some of whom will never work again.

Having said that, it is this dying "Reaganism" that stands in the way of policies that would most turn around this economy. With the gusher in the Gulf of Mexico, the need for a dramatic and dynamic shift to renewable energy would seem to be opportune. There is a need for bold moves FDR moves to get out of this economic slump that could become, as warned by Krugman, a full fledged depression. Unfortunately, this stalemate could stand in the way of a full economic recovery on the President's watch. RGN

June 27, 2010

The Third Depression

By PAUL KRUGMAN

Recessions are common; depressions are rare. As far as I can tell, there were only two eras in economic history that were widely described as “depressions” at the time: the years of deflation and instability that followed the Panic of 1873 and the years of mass unemployment that followed the financial crisis of 1929-31.

Neither the Long Depression of the 19th century nor the Great Depression of the 20th was an era of nonstop decline — on the contrary, both included periods when the economy grew. But these episodes of improvement were never enough to undo the damage from the initial slump, and were followed by relapses.

We are now, I fear, in the early stages of a third depression. It will probably look more like the Long Depression than the much more severe Great Depression. But the cost — to the world economy and, above all, to the millions of lives blighted by the absence of jobs — will nonetheless be immense.

And this third depression will be primarily a failure of policy. Around the world — most recently at last weekend’s deeply discouraging G-20 meeting — governments are obsessing about inflation when the real threat is deflation, preaching the need for belt-tightening when the real problem is inadequate spending.

In 2008 and 2009, it seemed as if we might have learned from history. Unlike their predecessors, who raised interest rates in the face of financial crisis, the current leaders of the Federal Reserve and the European Central Bank slashed rates and moved to support credit markets.

Unlike governments of the past, which tried to balance budgets in the face of a plunging economy, today’s governments allowed deficits to rise. And better policies helped the world avoid complete collapse: the recession brought on by the financial crisis arguably ended last summer.

But future historians will tell us that this wasn’t the end of the third depression, just as the business upturn that began in 1933 wasn’t the end of the Great Depression. After all, unemployment — especially long-term unemployment — remains at levels that would have been considered catastrophic not long ago, and shows no sign of coming down rapidly. And both the United States and Europe are well on their way toward Japan-style deflationary traps.

In the face of this grim picture, you might have expected policy makers to realize that they haven’t yet done enough to promote recovery. But no: over the last few months there has been a stunning resurgence of hard-money and balanced-budget orthodoxy.

As far as rhetoric is concerned, the revival of the old-time religion is most evident in Europe, where officials seem to be getting their talking points from the collected speeches of Herbert Hoover, up to and including the claim that raising taxes and cutting spending will actually expand the economy, by improving business confidence. As a practical matter, however, America isn’t doing much better. The Fed seems aware of the deflationary risks — but what it proposes to do about these risks is, well, nothing. The Obama administration understands the dangers of premature fiscal austerity — but because Republicans and conservative Democrats in Congress won’t authorize additional aid to state governments, that austerity is coming anyway, in the form of budget cuts at the state and local levels.

Why the wrong turn in policy? The hard-liners often invoke the troubles facing Greece and other nations around the edges of Europe to justify their actions. And it’s true that bond investors have turned on governments with intractable deficits. But there is no evidence that short-run fiscal austerity in the face of a depressed economy reassures investors. On the contrary: Greece has agreed to harsh austerity, only to find its risk spreads growing ever wider; Ireland has imposed savage cuts in public spending, only to be treated by the markets as a worse risk than Spain, which has been far more reluctant to take the hard-liners’ medicine.

It’s almost as if the financial markets understand what policy makers seemingly don’t: that while long-term fiscal responsibility is important, slashing spending in the midst of a depression, which deepens that depression and paves the way for deflation, is actually self-defeating.

So I don’t think this is really about Greece, or indeed about any realistic appreciation of the tradeoffs between deficits and jobs. It is, instead, the victory of an orthodoxy that has little to do with rational analysis, whose main tenet is that imposing suffering on other people is how you show leadership in tough times.

And who will pay the price for this triumph of orthodoxy? The answer is, tens of millions of unemployed workers, many of whom will go jobless for years, and some of whom will never work again.

Friday, June 4, 2010

Elections do have consequences: A Civil Rights Division...Again.

Obama promised a return to civil rights enforcement. Jerry Markon provides an update. Bush and the Republicans undermined the civil rights division of the Justice Department. With electon of Obama and his appointment of Eric Holder as Attorney General, the mission of the division is being restored. RGN

Justice Department's Civil Rights Division steps up enforcement

By Jerry Markon

Washington Post Staff Writer

Friday, June 4, 2010; A16

When Thomas E. Perez took over the Justice Department's Civil Rights Division in October, he found an office that was a shadow of its historic self.

Nearly 70 percent of the lawyers had left between 2003 and 2007, a mass exodus that came during allegations the Bush administration was politicizing hiring. Internal watchdogs concluded that the division's former head had refused to hire lawyers he labeled "commies" and had transferred one for allegedly writing in "ebonics," allegations the official denied. Civil rights groups said the unit had lost its traditional civil rights focus.

"We had to do some healing," said Perez, 48, a former Maryland official and deputy assistant attorney general under Republican and Democratic presidents. "We had to restore the partnership between the career staff and the political leadership. And frankly, certain civil rights laws were not being enforced."

That is changing: Justice Department officials say the division -- created in 1957 to help the Freedom Riders and students seeking to integrate public schools -- has stepped up enforcement of employment, disability rights and other anti-discrimination laws. Hate crimes and police misconduct are a renewed focus, and several section chiefs from the George W. Bush era have left. More than 30 people have been or are about to be hired as part of an 18 percent budget increase this year, the largest in the division's history. It will bring in 102 new people.

And in recent weeks, the division has taken a leading role in preparing for a possible Obama administration lawsuit against Arizona over the state's new immigration law.

"I think we have positioned the division to carry out its traditional mission of enforcement and be nimble enough to respond to emerging challenges," Perez said, citing cases such as a $6.1 million settlement with AIG subsidiaries to resolve allegations of discrimination against African American borrowers and the creation of a fair-lending unit in response to the economic crisis. The unit has 49 active investigations.

Justice officials could not provide overall comparisons with the first 17 months of the Bush administration, but in employment discrimination, for example, the Justice Department under President Obama filed 29 cases through March 20. One case was filed during the same period in the Bush administration.

The heightened focus on civil rights is a priority that flows directly from the top. Attorney General Eric H. Holder Jr. is a former civil rights lawyer who has vowed to make the division the department's "crown jewel," and Obama said in his January State of the Union address: "My administration has a Civil Rights Division that is once again prosecuting civil rights violations and employment discrimination."

Civil rights groups and some former Justice lawyers give the division generally high marks, though some Bush administration veterans and conservatives are critical.

"The division had been decimated, and as someone who spent more than 20 years there, I was very saddened to see the state of affairs," said Gerry Hebert, a former senior official in the division's voting section. He said Perez has made "a great start."

Robert N. Driscoll, a senior civil rights official in the Bush administration, credited Perez with securing large budget increases but said the division is "trying to intimidate political opponents." He cited the threats to sue over the Arizona law and a civil rights investigation of a controversial Arizona sheriff over tough immigration enforcement.

"Opening a case and saber-rattling is not accomplishing anything," said Driscoll, who is representing the sheriff, Joseph M. Arpaio. The department has acknowledged a civil investigation of Arpaio's office, and sources familiar with the case who spoke on condition of anonymity said a federal grand jury in Phoenix has been empaneled as part of a criminal probe.

Perez insisted it is actually the opposite, that the division has returned to its apolitical roots. As part of a theme he calls "restoration and transformation," he said hiring is once more primarily in the hands of career lawyers rather than political appointees. About 5,000 people have applied for jobs, and about a dozen who left in the Bush years have been rehired.

Among recent cases, the division obtained the largest-ever settlement of rental-discrimination claims under the Fair Housing Act: $2.7 million from the owners of Los Angeles apartment buildings for discriminating against African Americans and Hispanics. Prosecutors are also zeroing in on emerging areas of enforcement, such as growing threats to civil rights groups on the Internet.

A particular focus is restoring relations with such groups, which Perez calls "our eyes and ears." He added, "We can't be everywhere."

John Payton, president of the NAACP Legal Defense Fund, said the relationship is much improved. "When we call them, they listen," he said. "I think they're on track and on mission. It's just too early to tell what will happen."

Justice Department's Civil Rights Division steps up enforcement

By Jerry Markon

Washington Post Staff Writer

Friday, June 4, 2010; A16

When Thomas E. Perez took over the Justice Department's Civil Rights Division in October, he found an office that was a shadow of its historic self.

Nearly 70 percent of the lawyers had left between 2003 and 2007, a mass exodus that came during allegations the Bush administration was politicizing hiring. Internal watchdogs concluded that the division's former head had refused to hire lawyers he labeled "commies" and had transferred one for allegedly writing in "ebonics," allegations the official denied. Civil rights groups said the unit had lost its traditional civil rights focus.

"We had to do some healing," said Perez, 48, a former Maryland official and deputy assistant attorney general under Republican and Democratic presidents. "We had to restore the partnership between the career staff and the political leadership. And frankly, certain civil rights laws were not being enforced."

That is changing: Justice Department officials say the division -- created in 1957 to help the Freedom Riders and students seeking to integrate public schools -- has stepped up enforcement of employment, disability rights and other anti-discrimination laws. Hate crimes and police misconduct are a renewed focus, and several section chiefs from the George W. Bush era have left. More than 30 people have been or are about to be hired as part of an 18 percent budget increase this year, the largest in the division's history. It will bring in 102 new people.

And in recent weeks, the division has taken a leading role in preparing for a possible Obama administration lawsuit against Arizona over the state's new immigration law.

"I think we have positioned the division to carry out its traditional mission of enforcement and be nimble enough to respond to emerging challenges," Perez said, citing cases such as a $6.1 million settlement with AIG subsidiaries to resolve allegations of discrimination against African American borrowers and the creation of a fair-lending unit in response to the economic crisis. The unit has 49 active investigations.

Justice officials could not provide overall comparisons with the first 17 months of the Bush administration, but in employment discrimination, for example, the Justice Department under President Obama filed 29 cases through March 20. One case was filed during the same period in the Bush administration.

The heightened focus on civil rights is a priority that flows directly from the top. Attorney General Eric H. Holder Jr. is a former civil rights lawyer who has vowed to make the division the department's "crown jewel," and Obama said in his January State of the Union address: "My administration has a Civil Rights Division that is once again prosecuting civil rights violations and employment discrimination."

Civil rights groups and some former Justice lawyers give the division generally high marks, though some Bush administration veterans and conservatives are critical.

"The division had been decimated, and as someone who spent more than 20 years there, I was very saddened to see the state of affairs," said Gerry Hebert, a former senior official in the division's voting section. He said Perez has made "a great start."

Robert N. Driscoll, a senior civil rights official in the Bush administration, credited Perez with securing large budget increases but said the division is "trying to intimidate political opponents." He cited the threats to sue over the Arizona law and a civil rights investigation of a controversial Arizona sheriff over tough immigration enforcement.

"Opening a case and saber-rattling is not accomplishing anything," said Driscoll, who is representing the sheriff, Joseph M. Arpaio. The department has acknowledged a civil investigation of Arpaio's office, and sources familiar with the case who spoke on condition of anonymity said a federal grand jury in Phoenix has been empaneled as part of a criminal probe.

Perez insisted it is actually the opposite, that the division has returned to its apolitical roots. As part of a theme he calls "restoration and transformation," he said hiring is once more primarily in the hands of career lawyers rather than political appointees. About 5,000 people have applied for jobs, and about a dozen who left in the Bush years have been rehired.

Among recent cases, the division obtained the largest-ever settlement of rental-discrimination claims under the Fair Housing Act: $2.7 million from the owners of Los Angeles apartment buildings for discriminating against African Americans and Hispanics. Prosecutors are also zeroing in on emerging areas of enforcement, such as growing threats to civil rights groups on the Internet.

A particular focus is restoring relations with such groups, which Perez calls "our eyes and ears." He added, "We can't be everywhere."

John Payton, president of the NAACP Legal Defense Fund, said the relationship is much improved. "When we call them, they listen," he said. "I think they're on track and on mission. It's just too early to tell what will happen."

Subscribe to:

Comments (Atom)